Real estate. Smart and transparent.

Find, estimate and evaluate your properties in one place powered by AI.

Real estate, as easy as stocks. Promise!

With Leverage, you'll find the perfect property for you and get all the information that you need.

Features

Real estate the easy way. Leverage supports you from search 'til purchase and further.

1. Find perfect deals

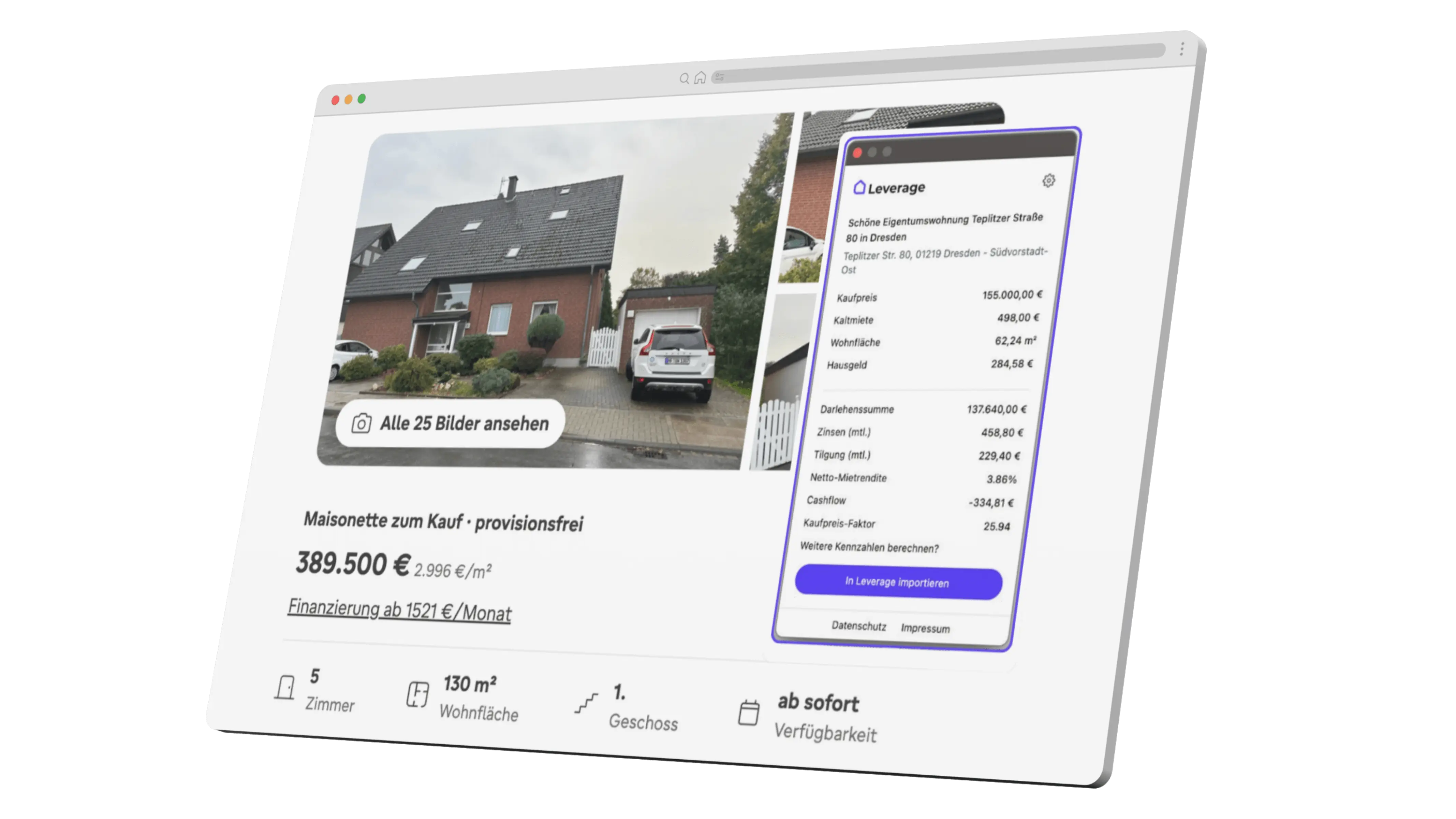

Levi automatically combs through portals like ImmoScout24, ImmoWelt, and eBay Kleinanzeigen and pulls all property data straight into your dashboard via an AI scraper. Copy and paste is yesterday.

2. Calculate returns

Cashflow, rental yield, IRR, and amortization schedule in seconds. Adjust assumptions, compare scenarios, and instantly see whether the deal is worth it.

3. Evaluate with AI

In-depth market and rental value analyses powered by PriceHubble and Levi AI help you recognize under- and overvaluations before purchase.

4. Buy stress-free

From the purchase-price offer to a bank-ready financing dossier with property data, cashflow forecast, and every supporting document—Leverage makes buying property easy.

5. Stay on top

Compare actual vs. target values at any time to see whether your portfolio is on track, and benchmark new properties against your existing assets.

Hey Levi!

With your smart investment assistant Levi, you always keep track of your investment opportunities. Whether you’re browsing ImmoScout24, ImmoWelt, eBay, or other portals, Levi delivers all the key metrics like return, cash flow, and more — in real time as you browse. One click is all it takes: copy and paste properties into Leverage, and all the information is instantly added to your real estate portfolio. Make investing easy and get a complete overview — in just seconds!

Plans and pricing

Get a premium membership to grow your real estate portfolio and keep track of it.

| Starter | Investor | Portfolio | |

|---|---|---|---|

3 | 12 | ∞ | Calculations per month, including Buy & Hold and Fix & Flip |

1 | 12 | ∞ | Real estate management (MF, SF, condo) |

0 | 2 | 10 | Search agent |

Key figures | |||

Search real estate with metadata | |||

Import listings in PDF or XLSX format | |||

Tax calculation | |||

Portfolio management and analytics | |||

Optimize financing | |||

Coupons from partners like Vermieterwelt, OhneMakler | |||

AI analysis of market value, property's location and other intel | |||

Export data for lenders in CSV |